Percipient is a partner in the global consortium selected to develop and operate API Exchange APIX, the world’s first open-architecture FinTech Marketplace and Sandbox platform.

IN THE NEWS

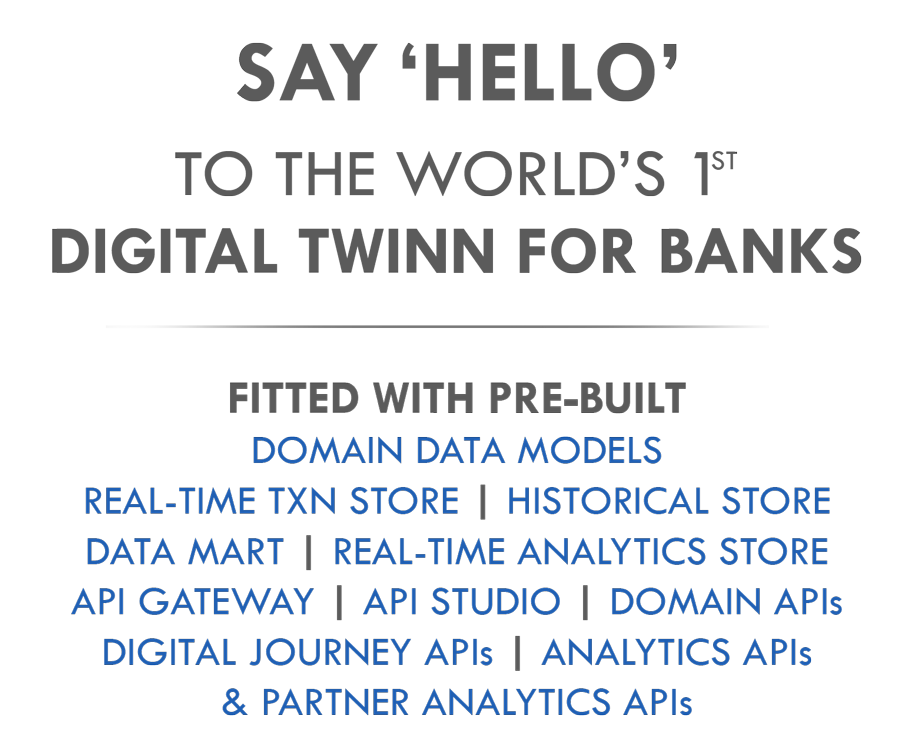

Navin Suri, CEO On Nasdaq TradeTalks Explaining the World’s 1st Digital TWINN for Banks

USA, Dec 2020

WHAT WE DO

Comprehensive Digital Suite

We help Financial Institutions speed-launch cross-product new-age digital capabilities regardless of existing system constraints

Pre-Built Digital Use Cases

We let Financial Institutions deliver a targeted end-to-end digital customer journey using our specialised APIs and widgets

Digital Starter Kit

We let Financial Institutions quick-launch their digital presence using a set of readymade APIs for core digital services

Power Digital Analytics

We help Financial Institutions start/enhance their AI and ML journeys by using our real-time data integration and pre-designed analytics APIs

How We Do It

Percipient’s TWINN solution helps FSIs create a twin of their legacy systems. The TWINN acts as a supercharged engine for enabling digital applications and takes away the heavy lifting needed to power these applications.

The TWINN offers the following capabilities:

Data Pipelines

Uses a range of patterns to enable 2-way connectivity to core systems

Digital Mirror

Livestreams data and event updates into real time enhanced data models

Domain & Analytics

Translates enterprise data, logic, processes and analytics into a catalogue of APIs

Digital Experiences

Choreograph APIs into composites that reflect state-of-the-art digital journeys

Marketplaces & Ecosystems

Acts as the bridge between internal and external data and processes to enable cross-industry platforms

PARTNERS

Use Cases

Contactless Customer Onboarding

In order to comply with KYC regulations, most financial organisations still require a branch visit when opening a first-time account. The Covid-19 pandemic has made it even more urgent that this process is made entirely contactless.

Recent advances in biometric and imaging technology makes this possible, but existing legacy architecture still prevent FSIs from adopting these. The TWINN offers a pre-configured contactless customer onboarding experience that can be supported using legacy systems. The solution comes complete with the required data models and APIs.

Instant Card Approval

Instant approvals of credit and debit card application makes sense in the modern era. While banks make every effort to secure appealing offers and rewards, the decision to redeem these offers are made in-the-moment. So card approvals are also needed in-the-moment.

To do this, banks require the ability to instantly assess a new or existing customer’s creditworthiness, using both externally and internally-sourced data. Based on pre-defined algorithms agreed with the bank, the TWINN solution enables banks to deliver the results to a mobile app in just a few seconds.

Real-Time Marketing Analytics

Today FSIs collect copious amounts of data based on their customers’ digital interactions. However, many fail to put this data to good use, especially when it comes to real time insights. For example, it is possible to offer personalized price discounts while a customer is online, based on an analysis of his/her past purchases and search patterns.

This requires not just the ability to ingest real time events, but also to run the analytics using appropriately constructed APIs. The TWINN offers a set of ready-made analytics APIs that helps banks launch these functionalities within an accelerated timeframe.

Copyright © 2020 Percipient Partners Pte. Ltd.

Percipient Partners Pte. Ltd.

80 Robinson Road, #09-04, 80RR, Singapore 068898