Banks want to upgrade their legacy systems. But will their new systems be able to support ever-changing customer journeys?

The need for banks to modernise their core systems is of course nothing new. However, the impetus for change has never been greater, and hence a new conversation has emerged about how this should be done.

If we look at US banks, until three years ago, even the top ones relied on mainframe systems that were decades old. In some cases, banks built these systems inhouse, while many others customised their store-bought systems to almost beyond recognition.

Driving force for change

It has thus been argued that banks are now seeing such DIY initiatives reach saturation point, or that their long term maintenance contracts are expiring. These factors are certainly adding weight to the need for a system re-vamp. But as citied in multiple surveys, the primary force driving change is the realization that legacy systems (even souped-up ones) simply cannot support the performance, functionality and agility required to enable new age, digital customer experiences.

A second, equally profound realization is that system modernisation is no longer a do-or-die affair based on hard-coded processes, closed architecture and a complete tech stack overhaul. Instead, banks now want to manage the risks, costs and future-readiness of system modernisations by taking a highly flexible, phased approach.

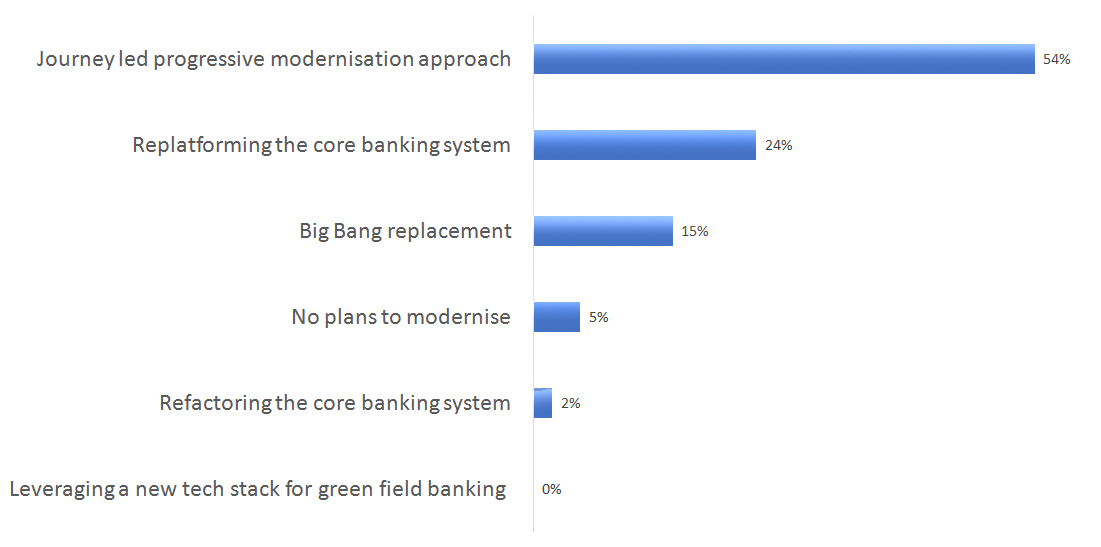

Again, this is borne out by recent surveys. A 2020 study by Capgemini and the Everest Group for example found that a significant 54% of US mid-market banks favoured journey-led, progressive modernisation, achieved by “building a digital wrapper around the core to create an open architecture through APIs”. This option far outweighed all others, including implementation of a next-gen digital core banking system.

Figure 1: Modernisation Approaches Preferred by Mid-Market Banks

Hollowing out of legacy platforms

The idea behind journey-led progressive modernisation is to wrap a core banking system with digital components that are composable and modular. This is not to say that banks adopting this approach can hang on to highly-antiquated core banking systems. But it does suggest that banks do not need to install digital-native, greenfield tech stacks to stay ahead of the curve.

The greenfield option is described in the Capgemini/Everest Group report as the implementation of “a next-generation core banking platform to create a digital banking entity and onboarding new customers to it”. This was favoured at a time when banks launched distinct digital bank entities to cater to a previously untouched segment of young, tech-savvy individuals. A ready-made, ready-to-go next-gen core banking platform allowed such digital banks to be launched quickly and at relatively low cost.

But that was then. Today, it has become clear that digital banking is not the exception, but the rule. And that with each passing year, bank customers, regardless whether digital novices or digital pros, expect their financial products and services to be even more friction-free, real time and personalised. It is responding to this pressure that is causing banks to progressively “hollow out” important customer journeys from legacy platforms, and rebuild them on new platforms as flexible, analytics-driven microservices.

Progressive modernisation-as-a-service

That said, progressive modernisation has its pitfalls. There are valid concerns that running old and new systems in parallel can result in a duplication of resources and costs, and an increase in operational confusion.

To overcome these challenges, banks need to plan and manage the transition from legacy to new in detail. On the one hand, they must have a keen understanding of customer-centric processes that can be enabled at each phase of the transition journey. On the other, they must engineer their source and target infrastructure to deliver these processes in a way that minimises the risk of service disruption and maximises the wow factor.

To date, this transition is handled by banks themselves, with or without help from their management consultants. What has been lacking in the market are ready-made solutions that enables banks to progressively upgrade their system capabilities while addressing the challenges. Percipient’s cloud-based Digital Bridge solution, underpinned by our Digital TWINNTM platform, is designed with exactly this need in mind.